Credit cards aren’t just convenient ways to pay for things. When used strategically, you can reap valuable rewards and perks you won’t get by paying with cash. Maximize your credit card rewards with these top 10 tips.

10. Pick the Best Rewards Credit Cards for Your Lifestyle

The best rewards credit card won’t be the same for everyone. It depends on how much you spend on different categories. If you often shop at the same retailers, consult this chart to see which credit cards will save you most at those stores. If you shop mainly at Amazon, some credit cards are more rewarding for that than others. If you’re a frequent traveler, you might be interested in credit cards that give you free hotel stays or companion plane tickets. We’ve rounded up some of the best credit cards for earning rewards here and compared five rewards credit cards in our Hive Five. You can also consult this graphic, which compares 25 popular rewards credit cards. So many to choose from!

9. Use a Cash Back Shopping Portal

Every time you shop online, you can earn extra points, miles, or cash back. Your credit card bank has its own shopping portal you can start your shopping spree from, such as Chase’s Ultimate Rewards, but there are also cash back sites such as Ebates and FatWallet. The rewards will differ depending on where you’re shopping. To that end, find the right shopping portal for each store using a site like Cashback Monitor or previously mentioned Evrewards.

8. Buy and Sell Gift Cards for More Cash Back

If your card offers double (or more) points for shopping at a store where gift cards are sold, such as grocery stores or office supply stores, buying gift cards there could earn you bonus rewards. Keep in mind, however, this depends on your credit card company and the store you’re shopping at: Some stores will mark that you bought a gift card there and some banks don’t allow bonuses on them. Also, if you redeem your credit card rewards for gift cards, you can turn around and sell them to boost your return, depending on your credit card’s cash back rates.

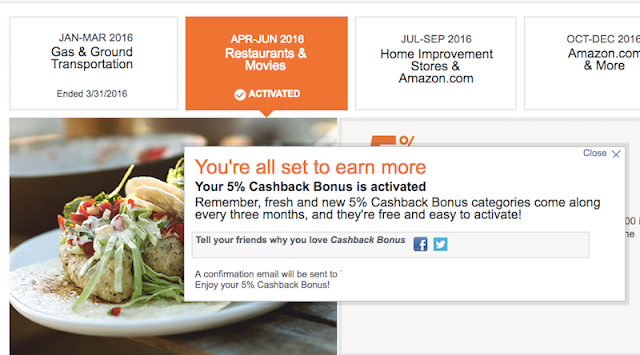

7. Activate Your Rewards Categories

This one’s a no-brainer, but often we forget to activate the rotating rewards offered by our credit cards. You’ll usually get a reminder email from the credit card company, but you could also set a calendar reminder for activating the bonus categories. They usually happen quarterly.

6. Ditch the Annual Fee

Certain rewards credit cards, particularly travel rewards cards, charge annual fees. Sometimes the benefits are worth it, but if you get the annual fee waived, you’ve just boosted the card’s value. All you have to do is ask. They might say no, but it’s worth a shot.

5. Time Your Credit Card Sign-up for the Biggest Bonuses

Occasionally, credit card companies increase the sign-up bonuses, which can be worth free flights or hundreds of dollars. That’s the best time to get a rewards credit card, not when they’re offering the normal sign-up bonus. NerdWallet found the best times of the year to get these extra bonuses.

4. Use Your Credit Card’s Hidden Perks

Beyond the popular benefits like cash back and purchase protection, most credit cards offer other rewards, such as travel insurance and roadside assistance. Check your policy to avoid spending on benefits already covered by your credit card.

3. Connect Your Credit Cards to Loyalty Programs

There are a few loyalty programs that reward you for dining out or shopping at particular places. Join the program and connect your credit card, and each time you eat or shop there, you’ll earn rewards towards cash back or miles. Or in Upromise Dining’s case, cash towards college. iDine, AAdvantage Dining, and Thanks Again are other programs to consider.

2. Rotate Your Credit Cards and Use Them for Everything

You’ll get even more rewards if you have multiple cash back credit cards, since each pays more for different categories. I have a dedicated card for grocery shopping, for example, for 5% cash back, a card for Amazon purchases, a regular 2% cash back card, and so on. If you have a hard time remembering which credit card is for what, keep a cheat sheet in your wallet. Also, if you’re responsible and pay off all your purchases every month, use your credit cards for everything, even bills if possible.

1. Redeem Your Points and Miles

Finally, don’t let your miles or points just sit around in your credit card account. Some rewards expire. Even if yours don’t, the biggest mistake people make with their credit card rewards is not using them. (Although saving them for a big trip or for emergency flights is fine too.) If you have no need for your rewards, you can donate them or gift them to a family member or friend (or me).

All this said, remember to always make your credit card payments on time. Otherwise, you can not only lose your rewards, you could find yourself in a debt hole not worth the credit card rewards to begin with.

Illustration Fruzsina Kuhári.

via: lifehacker.com

Nincsenek megjegyzések